Balance Sheet

One measure of an institution's financial health is whether or not expendable fund balances are growing at a rate equal to or greater than the growth in expenditures. For the University, expendable fund balances primarily consist of the current funds and the quasi-endowment funds. The net  assets, the University's equity in these funds, can be more readily converted into cash than the equity in the nonexpendable funds, such as investment in plant and true endowment funds.

assets, the University's equity in these funds, can be more readily converted into cash than the equity in the nonexpendable funds, such as investment in plant and true endowment funds.

The information presented in Figure 1 represents solid performance. Over the four-year period, June 30, 1990, to June 30, 1994, the University's expendable fund balances have exceeded the University's growth in expenditures. However, the current year's performance of 76 percent represents a decrease from 1993's 81 percent. During fiscal year 1994, the University's expendable fund balances essentially stayed at their 1993 levels, while expenditures increased just under 7 percent. The major reason for the lack of growth in expendable fund balances was that the quasi-endowment funds' market value, which comprises over half of the University's expendable fund balances, was unchanged from 1993.

Current Operations

A critical question for any organization is whether revenues exceed expenditures. If they do not, the organization will be unable to retain a  portion of revenues for use in future years when needs may exceed resources.

portion of revenues for use in future years when needs may exceed resources.

Figure 2 shows the net revenues as a percentage of total revenues for the University's operating segments, measuring the degree to which revenues exceed expenditures. On a consolidated basis, the University's revenues exceeded expenditures during the year by 3.2 percent, a decrease from 1993's 4.6 percent. Each of the three operating units of the University, educational and general, auxiliary enterprises, and the medical center experienced decreases in their percentages for 1994 compared to 1993.

A major reason for the consolidated percentage decrease was that the medical center's net revenue as a percentage of total revenue decreased from 4.6 percent in 1993 to 2.2 percent in 1994. The decline was attributable, in part, to a continued slowing in the growth of revenue because of reduced inpatient activity. A more detailed discussion of the medical center's financial activity is presented later in this report.

Since 1991, the educational and general segment percentage has been decreasing and now stands at its 1990 level. The decreasing percentages correspond to the reduced state support the University has received since 1991. The 1994 result, although adequate, was not unexpected given that state appropriations increased by only 3.5 percent. Although other educational and general revenues increased 9 percent and exceeded the growth in expenditures of 8 percent, this activity did not fully compensate for the low growth in state appropriations for 1994.

The auxiliary enterprises experienced a slight decrease from last year and the combined percentage of net revenues stands at just over 14 percent. When evaluating the results for the auxiliary enterprises, it must be noted that the percentages do not reflect all expenditures related to the replacement of equipment and renovation of facilities. Such expenditures, which are a significant component of their operations, are generally recorded in reserve accounts that are not included in the current funds. It is also important to note that the auxiliaries are required to generate all revenues through use charges and, therefore, do not receive state appropriations.

Credit Worthiness

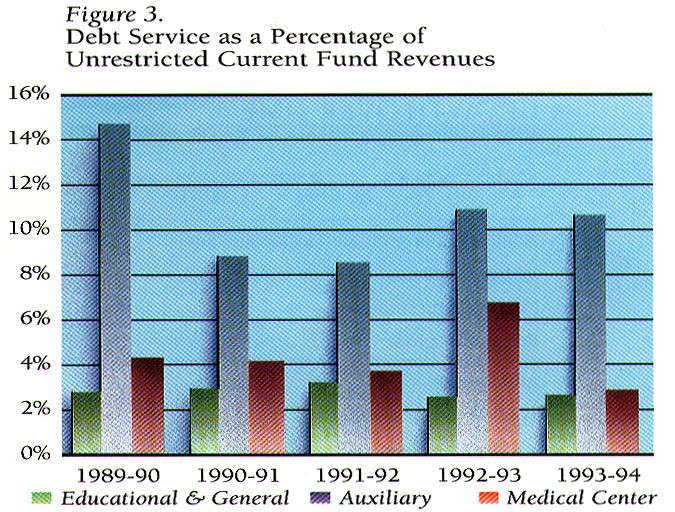

Another equally important financial indicator is the University's ability to satisfy its annual debt service obligations from current revenues. Just as the University is expected to fund operations from current revenues, it must also repay its borrowings from these revenues. The University continues to maintain a positive relationship between annual debt service requirements and unrestricted revenues. Overall, the University's debt service was 3.4  percent for fiscal year 1994 and was a significant improvement over the 5.4 percent for 1993. This particular measure (where lower percentages are a more positive indicator) is most significant when analyzed for each separate unit, as shown in Figure 3, since debt issued for each operational unit should be repaid from resources generated by that unit.

percent for fiscal year 1994 and was a significant improvement over the 5.4 percent for 1993. This particular measure (where lower percentages are a more positive indicator) is most significant when analyzed for each separate unit, as shown in Figure 3, since debt issued for each operational unit should be repaid from resources generated by that unit.

Despite the wide variance in debt service percentages, each segment's measure is well within acceptable guidelines. The significant improvement in the medical center's percentage for 1994 is a result of the medical center's debt refinancing in 1993. The 1993 percentage was unusually high due to the defeasance of the medical center bond issues.

Endowment Funds

The University's endowment totaled $641 million, as of June 30, 1994, and consistently ranks among the thirty largest endowments for colleges and universities and among the five largest for public institutions. During 1994 (Figure 4), the endowment grew by $3 million. Of the $3 million increase, $2 million is attributable to gains and $8 million to gifts, while net transfers out of the endowment totaled $7 million. Since June 30, 1990, the market value of the endowment has grown by $154 million.

In managing the endowment, the University must strike a balance between the dual and often competing objectives of providing income to the current University community and of providing growth in the underlying assets, so that a gift given today will provide the same level of real support to the future University community. In order to satisfy these dual objectives, the Consolidated Endowment, totaling $506 million, sets its annual distribution to the University at approximately 4 percent of the market value, leaving the excess return over spending to the appreciation of the underlying assets. The Eminent Scholar Endowment, totaling $97 million, is the investment fund for endowment assets which are eligible for income supplements by the Commonwealth. In order to maximize participation by the Commonwealth while allowing for limited appreciation, spending for the Eminent Scholar pool is set at approximately 6 percent. The remaining $45 million represents separately invested endowment assets. Not included in the endowment controlled by the University are assets held in trust for the benefit of the University and endowments held by the University's related foundations.

In managing the endowment, the University must strike a balance between the dual and often competing objectives of providing income to the current University community and of providing growth in the underlying assets, so that a gift given today will provide the same level of real support to the future University community. In order to satisfy these dual objectives, the Consolidated Endowment, totaling $506 million, sets its annual distribution to the University at approximately 4 percent of the market value, leaving the excess return over spending to the appreciation of the underlying assets. The Eminent Scholar Endowment, totaling $97 million, is the investment fund for endowment assets which are eligible for income supplements by the Commonwealth. In order to maximize participation by the Commonwealth while allowing for limited appreciation, spending for the Eminent Scholar pool is set at approximately 6 percent. The remaining $45 million represents separately invested endowment assets. Not included in the endowment controlled by the University are assets held in trust for the benefit of the University and endowments held by the University's related foundations.

For 1994, the Consolidated Endowment distributed $23 million and the Eminent Scholar Endowment distributed $5 million. The use of endowment income may be restricted to a specific purpose by the donor or it may be unrestricted and directed at the president's discretion. As of June 30, 1994, 68 percent of the total endowment was restricted and 32 percent was unrestricted.

Medical Center

The medical center's excess of revenues over expenses from operations was $15 million, or 3.9 percent of total revenue for 1994. Total revenue of $387 million for 1994 exceeded last year's total revenue of $384 million by less than 1 percent. Non-operating gains of $2.5 million for 1994 were greater than the previous year's $2.4 million. The financial results from fiscal year 1994 were up slightly from the previous year. During 1994, the medical center provided 176,894 days of patient care, which is 9.2 percent below the previous year. This decline was a result of the reduction in the length of time patients are staying in the hospital. The length of stay also declined by 8.3 percent from 7.2 days to 6.6 days. There was a 2 percent decrease in the number of patients admitted in 1994 to 27,252, and the number of clinic and emergency visits increased to 407,589 or 3.2 percent higher than 1993.

In response to changes in the health care market-place, management has implemented its Value Improvement Plan to improve patient services and to reduce the costs of those services. By implementing a hiring freeze, the medical center was able to reduce the number of FTEs from 4,866 in August 1993 to 4,416 by June 1994. This allowed the medical center to limit the growth in operating expenses to 2.6 percent for 1994.